Investing in our Future and Wellbeing

Castries, Saint Lucia – Prime Minister Hon. Philip J. Pierre, with the support of his Cabinet of Ministers, devised the Health & Citizen Security Levy (HCSL) to improve the government’s financial ability to provide quality healthcare services to the public and reinforce Saint Lucia’s national security infrastructure for a safer and more secure country.

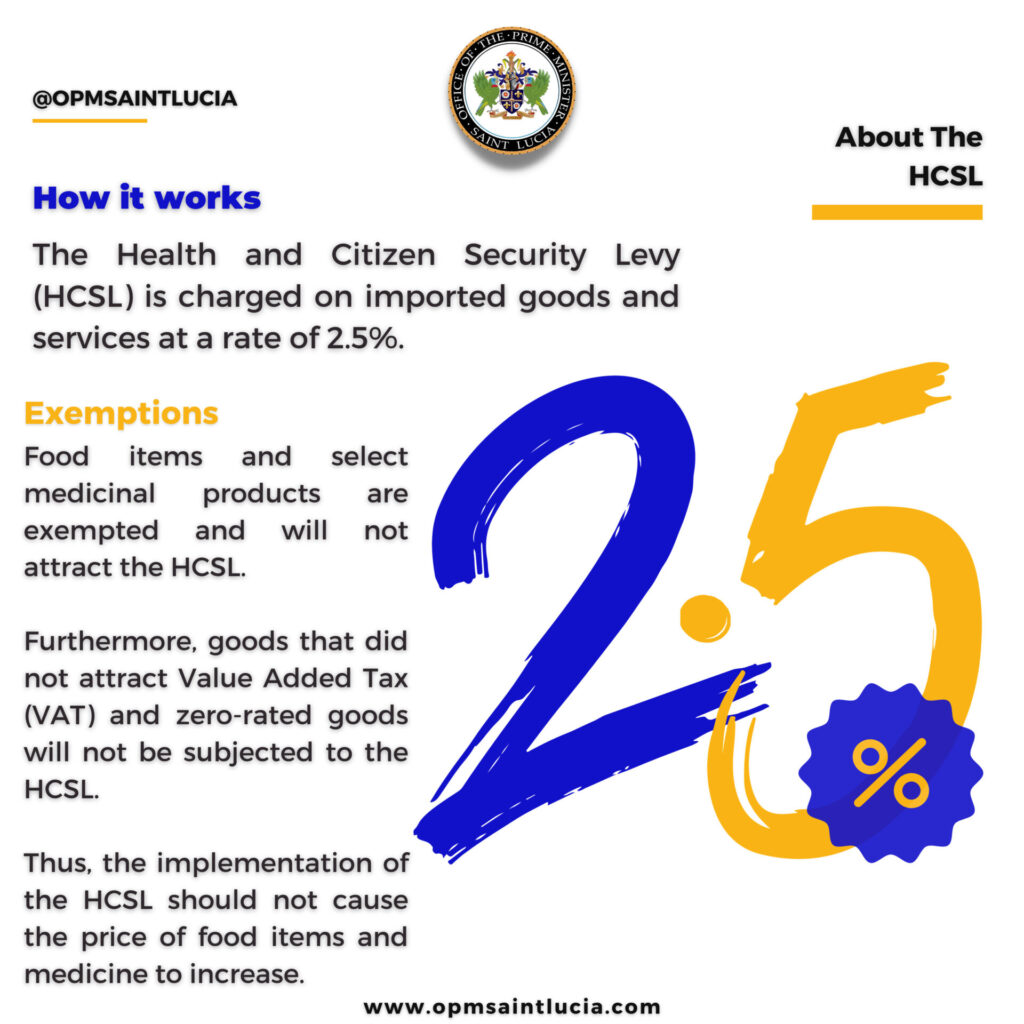

Legislation establishing the HCSL was passed in the Parliament in July 2023. The HCSL is charged on imported goods and services at a rate of 2.5%. The Department of Customs and Excise applies the HCSL to goods entering Saint Lucia that are not on the exemption list. The Inland Revenue Department collects the HCSL from service providers.

The application of the HCSL on goods entering Saint Lucia became effective as of August 2, 2023. The application of the HCSL on services became effective as of October 2, 2023.

Food items and select medicinal products are exempted and will not attract the HCSL. Furthermore, goods that did not attract Value Added Tax (VAT) and zero-rated goods will not be subjected to the HCSL. Thus, the implementation of the HCSL should not cause the price of food items and medicine to increase.

The Government of Saint Lucia is expected to annually generate approximately $33 million XCD in new revenue from the HCSL. This revenue will improve the government’s fiscal ability to expand public health services, further reduce the cost of medical services and provide a higher quality of healthcare services to improve the health and wellbeing of our nation.

The Health and Citizen Security Levy is an investment in our community, our country – our people.

ENDS

Leave a comment

You must be logged in to post a comment.