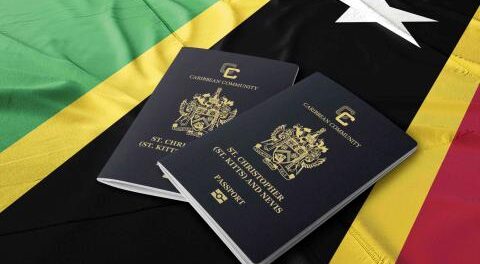

The Tale of Drew Administration’s Destruction of the St. Kitts and Nevis CBI Programme: From Market Leader to a Shadow of Its Former Self in 2 Years

by Concerned Citizen,

In an address delivered last Thursday night, Prime Minister Dr. Terrance Drew of St. Kitts and Nevis acknowledged the collapse of the once-thriving Citizenship by Investment (CBI) Programme. Just two years prior, St. Kitts and Nevis had a CBI programme that was globally respected for its robust due diligence, integrity, and efficiency, placing it far ahead of regional competitors. Under the stewardship of Team Unity, the CBI programme boasted visa-free access to over 150 countries and enjoyed an impeccable reputation without a single warning from major Western countries or entities such as the U.S. Financial Crimes Enforcement Network (FINCEN).

Today, however, the programme has drastically declined, with revenue dropping by more than 50% to a mere $218 million, a record low that has seen the programme slide to last place among Caribbean CBI options. While countries like Antigua and Grenada report record applications, St. Kitts and Nevis’ CBI programme finds itself in ruins. Let’s examine the series of missteps and questionable decisions that led to this unprecedented decline.

Key Missteps Leading to the Collapse of the St. Kitts and Nevis CBI Programme

- Ill-Informed Regulatory Changes

The Drew administration introduced sweeping changes to the CBI programme without adequate research or stakeholder consultation. Key players in the industry, both local and international, were not given a voice in shaping these changes, leading to uncertainty and reduced confidence among investors. - Confusing and Repealed Regulations

The administration’s poorly planned regulations were quickly repealed, creating confusion for developers, service providers, and International Marketing Agents (IMAs). This lack of stability, coupled with delayed responses from the new CEO Patrick Martin, led to widespread fear in the market and a significant erosion of trust. - Association with Convicted Fraudster

In 2023, the Drew administration’s promotion of convicted fraudster Philippe Martinez as a public benefactor cast further doubts on the integrity of the programme. Martinez’s claim during a digital launch that the CBI programme was under investigation by international authorities alarmed stakeholders and increased scrutiny from the EU and U.S. markets. - RICO Lawsuit Impact

The RICO lawsuit, which implicated the National Bank and certain government-affiliated figures in alleged criminal behavior, further damaged the programme’s reputation. The ongoing court case has cast a dark shadow over the CBI programme, discouraging potential investors from associating with a programme mired in allegations of criminal activity. - Weaponizing CBI Programme for Political Gain

The Drew administration has been accused of weaponizing the CBI programme to target political opponents, a tactic that alienated potential investors. Investors feared becoming embroiled in political conflicts, deterred by a perceived lack of stability and respect for the rule of law in the country. - Revocation Threats by Dr. Drew

Prime Minister Drew’s public threats to revoke thousands of passports—despite having signed Certificates of Registration (CORs) for many investors—sent shockwaves through the investor community. Such a move appeared both retaliatory and untrustworthy, leading to perceptions of instability and unpredictability. - Publicized Legal Actions and Communications Leak

The high-profile legal filings to withdraw passports and the leak of a WhatsApp message allegedly sent by the AG Wilkin to Dwyer Astaphan (an advisor to Philippe Martinez) deepened concerns over the programme’s reliability. The incident underscored an environment in which sensitive information might not be safeguarded, further undermining investor confidence. - Loss of International Credibility

Under Dr. Drew’s leadership, St. Kitts and Nevis has lost the respect of the international community. Concerns about transparency, integrity, and stability have effectively removed the “platinum” status of the CBI programme, diminishing the country’s appeal as a safe investment option.

Consequences for St. Kitts and Nevis

The collapse of the CBI programme represents a severe economic blow for St. Kitts and Nevis, which has traditionally relied on it as a key source of national revenue. The consequences extend far beyond finances, impacting the nation’s reputation and its ability to attract future investments. As competing CBI programmes in the region thrive, the once-esteemed programme in St. Kitts and Nevis lies in ruins, a casualty of poor governance and damaging policy decisions.

Conclusion: A Legacy of Failure

Prime Minister Dr. Terrance Drew’s administration has, in the eyes of many, sacrificed one of the federation’s most prized assets. The decisions and actions taken by the Drew government have undermined investor trust, compromised the country’s reputation, and ultimately damaged the financial stability of St. Kitts and Nevis. As the government grapples with the fallout, the people of St. Kitts and Nevis are left to bear the consequences of a once-flourishing programme that has now been decimated.

Leave a comment

You must be logged in to post a comment.