ST.KITTS: CREDIT REPORTING BILL TO HELP INDIVIDUALS AND BUSINESSES EXERCISE FISCAL RESPONSIBILITY

Get our headlines on WHATSAPP: 1) Save +1 (869) 665-9125 to your contact list. 2) Send a WhatsApp message to that number so we can add you 3) Send your news, photos/videos to times.caribbean@gmail.com

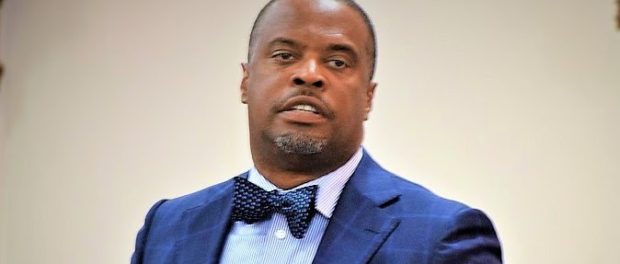

Hon Mark Brantley

Hon Mark Brantley

Basseterre, St. Kitts, September 06, 2018 (SKNIS): At the sitting of the National Assembly on September 06, Premier of Nevis, the Honourable Mark Brantley, added his support for the safe passage of the Credit Reporting Bill 2018, which seeks to establish a regulatory and supervisory structure to support an advanced and fair credit reporting system in St. Kitts and Nevis.

“I want people to appreciate that sometimes we need to be protected from ourselves. We recognize that debt is something that all of us have but it is necessary Mr. Speaker that we have manageable debt,” stated Minister Brantley, while addressing the honourable House.

He noted that in the Federation there is the development of a culture of “instant gratification” where persons put themselves in debt to get what they want “now” rather than waiting for a time where they are in a better financial situation to afford what they need.

“I believe that we have a responsibility to say to our people that they must be responsible and responsible behavior demands that we conduct ourselves in such a way Mr. Speaker that we don’t create problems for ourselves and our family going forward. It is very important I feel therefore, that this legislation has come at a time like this because as has been carefully laid out, it provides now an infrastructure that credit and credit scores can be determined,” he said.

The minister noted it is vital to go back to the societal norms where older persons would say “don’t spend what you don’t have” and be responsible. He also stated that it is important to develop a habit of saving rather than getting into debt to purchase items.

He also noted that the Bill is not only important for individuals but also lending agencies for them to exercise responsibility with their lending. He stated that credit institutions often make it appealing or easy for individuals to get loans or higher purchases with minimal down payments, leaving the individual with debt they may not be able to afford in the long run.

“Our people out there need to understand Mr. Speaker that the habit, culture and appetite that has developed for instantaneous gratification, they have to control it. What this legislation is seeking to do is that now with the credit scores and the credit bureau, the business houses themselves will now have an obligation to do the proper due diligence,” he said.

Minister Brantley further stated that the Bill is an important document in the government’s mission to make things better for the people of the Federation by creating the framework for business houses to have better business practices.

“I want with these words Mr. Speaker to lend my full support to this legislation. I commend the mover of the bill for bringing it at a time like this because I believe it will provide genuine relief for people along the length and breadth of this our beloved country,” said Minister Brantley.

Leave a comment

You must be logged in to post a comment.